Compound interest (or compounding interest) is interest calculated on the initial principal, which also includes all of the accumulated interest of previous periods of a deposit or loan.

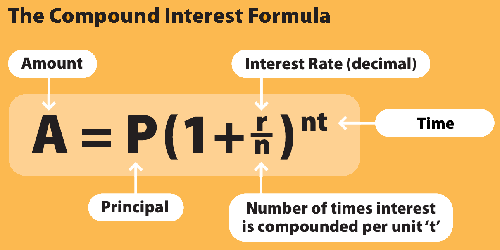

P = principal amount (the initial amount you borrow or deposit)

r = annual rate of interest (as a decimal)

t = number of years the amount is deposited or borrowed for.

A = amount of money accumulated after n years, including interest.

n = number of times the interest is compounded per year

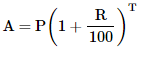

1. When interest is compound Annually :

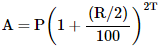

2. When interest is compounded half-yearly :

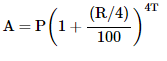

3. When interest is compounded quarterly :

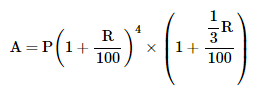

4. When interest is compounded annually, but time is in fraction, say 4  years :

years :

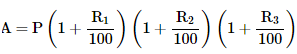

5. When rates are different for different years, say R1%, R2% and R3% for 1st, 2nd and 3rdyear respectively.

Wherever the term compound interest is used without specifying the period in which the interest is compounded, it is assumed that interest is compounded annually.

Compound Interest (CI) = A – P

Simple Interest and Compound Interest for 1 year at a given rate of interest per annum will be equal.

https://gyangossip.com/quantitative-aptitude/mock-test/T5029

https://gyangossip.com/quantitative-aptitude/mock-test/T10857